WHAT IS FOREX

Forex trading, short for foreign exchange trading, is the process of buying and selling currencies with the aim of making a profit. It operates on the principle of exchanging one currency for another at an agreed-upon price. The forex market is the largest financial market in the world, with trillions of dollars traded daily.

◊Participants in the forex market include banks, financial institutions, corporations, governments, and individual traders. Currency pairs are traded, with the most commonly traded pairs being EUR/USD (euro/US dollar), USD/JPY (US dollar/Japanese yen), GBP/USD (British pound/US dollar and USD/CHF (US dollar/Swiss franc).

◊Forex trading can be done through various methods, including spot transactions (buying or selling currencies for immediate delivery), forward contracts (agreements to buy or sell currencies at a future date at a predetermined price), futures contracts (similar to forwards but traded on exchanges), and options contracts (giving the holder the right but not the obligation to buy or sell currencies at a predetermined price).

◊Traders in the forex market aim to profit from fluctuations in currency exchange rates by speculating on whether a currency will appreciate or depreciate in value relative to another currency. They use various analysis methods, such as technical analysis (studying past price movements) and fundamental analysis (examining economic indicators and geopolitical events), to make informed trading decisions. Forex trading carries risks, including the potential for substantial financial losses, and it requires careful risk management and an understanding of market dynamics.

Broker Reviews

WARNING

Online Forex Trading Risks Ahead!

Before diving into online forex trading, it’s crucial to understand the risks involved. Here are some key warnings:

1. High Volatility: The forex market is known for its rapid and unpredictable price movements. While this volatility can present lucrative trading opportunities, it also increases the risk of significant losses.

2. Leverage Amplifies Losses: Forex trading often involves the use of leverage, which allows traders to control larger positions with a relatively small amount of capital. While leverage can magnify profits, it can also amplify losses, leading to rapid account depletion.

3. Market Liquidity: In times of extreme volatility or economic uncertainty, liquidity in the forex market can dry up. This lack of liquidity can lead to slippage, where orders are executed at a different price than expected, potentially resulting in unexpected losses.

4. Educational Requirements: Successful forex trading requires a solid understanding of fundamental and technical analysis, as well as risk management strategies. Lack of proper education and experience can lead to poor decision-making and substantial losses.

5. Broker Risks: Choosing a reputable forex broker is essential, as the industry is not immune to scams and fraudulent activities. Ensure your broker is regulated by a reputable authority and has a track record of reliability and transparency.

6. Psychological Challenges: Forex trading can be emotionally taxing, especially during periods of sustained losses or when facing significant market fluctuations. Emotional decision-making often leads to impulsive actions and further losses.

7. Capital Preservation: Never trade with funds you cannot afford to lose. Successful traders prioritize capital preservation and employ risk management techniques such as setting stop-loss orders to limit potential losses.

8. Market Research: Keep abreast of global economic and geopolitical events that can impact currency prices. Failure to stay informed may result in missed opportunities or unexpected losses.

9. No Guarantees: Despite careful analysis and risk management, trading outcomes are never guaranteed. Accept that losses are part of the trading process and maintain a disciplined approach to mitigate risk.

10. Seek Professional Advice: If you’re unsure about any aspect of forex trading, seek advice from a qualified financial advisor. They can provide personalized guidance based on your financial situation and risk tolerance.

Remember, while forex trading offers the potential for substantial profits, it also carries significant risks. Approach the market with caution, diligence, and a commitment to ongoing education and risk management.

Our Rating

- Exness is regulated by several top-tier financial authorities like CySEC and FSA

- No overnight fees.

- Free VPS.

- Low and Stable spreads.

- Customizable leverage.

Our Rating

- Ultra-fast execution.

- Provides multiple trading platforms (MT5, MT4, and cTrader).

- Low and stable spreads.

- All Instruments: Spread only (0 commission).

Our Rating

- Very low transaction costs.

- Small Initial investment to start trading.

- Fast execution.

- It operates under regulation from various financial authorities, including (CySEC, ASIC, and IFSC).

education

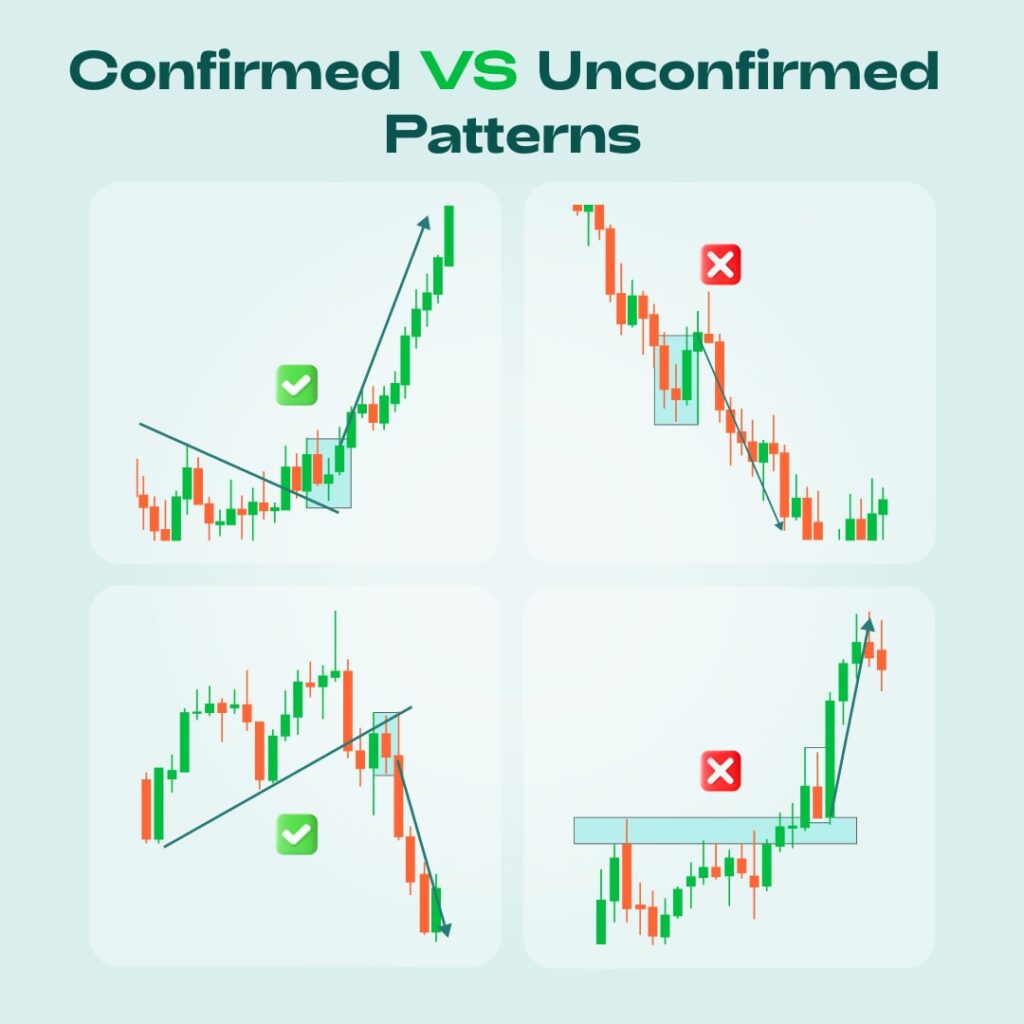

Confirmed VS Unconfirmed Patterns

When it comes to patterns, make sure that they are confirmed!

Let’s look at the examples and compare two pairs of patterns.

1️⃣On the top left picture, we see three confirmations for a “BUY” signal: the price has completed the corrective movement; a higher low has formed; the direction of the signal coincides with the general trend direction. Then the price continued the uptrend.

❗️On the top right picture, the pattern is false for two reasons: first, it was against the overall trend, but before entering the reversal setups, waiting for a retest is crucial! And second, a lower high and a lower low have formed.

2️⃣ On the bottom left, the “SELL” signal is confirmed by four things: overall downtrend; completed correction phase; an important resistance level; and lower high. The price then continued its downtrend.

❗️ However, on the bottom right, the pattern is false. The signal is against the overall trend, higher high is formed, and the resistance zone is broken.

Don’t underestimate these main confirmations while trend trading:

-Compliance with the overall trend.

-Lower/higher highs/lows.

-The presence of a support / resistance zones.

-Fibonacci levels.

-Trend lines.

👌🏻Always double confirm the trend, and don’t rush!

The History Of Forex Trading

Forex trading, short for foreign exchange trading, has a rich history that dates back centuries. Here’s a brief overview:

1. Origins: Forex trading can be traced back to ancient times when people exchanged currencies to facilitate international trade. However, it wasn’t as organized or regulated as it is today.

2. Gold Standard: In the 19th century, many countries adopted the gold standard, which pegged their currencies to a specific amount of gold. This system facilitated stable exchange rates.

3. Bretton Woods Agreement: After World War II, the Bretton Woods Agreement established a fixed exchange rate system with the U.S. dollar as the primary reserve currency. This system lasted until 1971 when President Richard Nixon suspended the U.S. dollar’s convertibility into gold.

4. Floating Exchange Rates: Following the end of the Bretton Woods system, currencies began to float freely against each other. This marked the beginning of modern Forex trading as we know it today.

5. Electronic Trading: The 1990s saw the transition to electronic trading platforms, making it more accessible to retail traders. This technological advancement revolutionized the industry.

6. Retail Forex: With the internet boom in the early 2000s, retail Forex trading became widely available to individual investors, not just institutional players.

7. Regulations: Forex markets are now heavily regulated to ensure fair practices and protect traders. Regulatory bodies like the Commodity Futures Trading Commission (CFTC) in the United States oversee the industry.

8. Evolution: Forex trading has continued to evolve with the rise of algorithmic and high-frequency trading, as well as the development of various trading strategies and tools.

Today, the Forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $6 trillion as of my last knowledge update in 2022. It remains a key player in the global financial landscape.

Best Times To Trade

🧐What is the ideal moment for an entry?

😒Finding the best way to enter the market may be challenging for newbies. Some of them constantly look for ideal indicators and other hidden techniques. In reality, a trader can open a trade based on straightforward and understandable rules. Let’s look at them!

👆Every trader knows they must look at trends and levels to catch the right moment for an order. After you draw them, focus on breakouts! Below, we list three scenarios you can face on the charts.

✅Breakout of a trendline + retest. If the price crosses the trend line, it signals you to enter the market soon. Don’t rush into trading after a big spike occurred! It’s better to wait for a retest of the trendline, as the price tends to correct towards it after a huge momentum occurs. After a retest of a trend line happens, you are ready to place an order!

✅Breakout of the market structure + retest. If the price breaks a resistance/support zone, this is also a good sign to consider order. To confirm your signal, wait for a retest of the zone.

✅Pullbacks. If the price moves within a strong trend, you can enter on pullbacks (corrections) to the trend line.